A new era in cross-border transparency

The European Commission has published a new regulation on cross border payments which radically increase transparency on currency conversion costs. In this article, our CCO, Ross Leonard, expands on the implications for Banks and how the neo-banks have a head-start in meeting the new regulatory requirements.

On 14th February the European Commission published a new regulation on cross border payments which has the potential to radically alter the market for both the card and money transfer industries.

A New Era in Cross Border Transparency

Foreign currency rates and fees have long been a source of contention with end-consumers who have difficulty comparing cross border payment services that use differing fees, rates and commission structures. While the growth of disruptive new entrants such as Revolut, Curve and TransferWise has improved the range of products & services available, the new regulation will drive a significant increase in the transparency associated with the currency conversion rates and transfer fees applied to all forms of cross border payments within the EU.

The EU regulation creates a common approach to pricing for foreign currency transactions, with all fees, commissions and exchange rate premiums consolidated into a single currency conversion cost that will be compared to the ECB reference rate for that day, with the difference between the two expressed clearly as a percentage (%). By Q2 2020, all banks that issue payment cards must clearly present the currency conversion cost in their terms & conditions and on a publicly available website and by Q2 2021, those banks must also send their customers electronic notifications (SMS, email, push) of the currency conversion cost after each cross border, foreign currency card transaction.

Challenges for the Banking Sector

Implementation of the new regulation will create challenges for European banks as they meet this new transparency regulatory requirement and respond to the competitive threat posed by newer market entrants.

Timeliness of Communication.

Foreign currency exchange rates for payment card transactions are typically set when the merchant presents the transaction for clearing, not when the customer initiates a payment. As a result, the currency exchange rate is typically set 3-5 days after a transaction. For Banks to provide an accurate presentment of the currency conversion cost, they will have to wait until the payment transaction clears and the final exchange rate is set. This will result in the Bank sending the customer the notification several days after the transaction, creating customer confusion and reducing the relevancy of the content. It is worth noting that these constraints will not apply to new, advanced service providers, such as Revolut, Curve or TransferWise, which have greater control over their card payment FX rates and are able to communicate accurately in real time with their consumers – a significant competitive advantage for their digital banking experiences.

Inconsistent Customer Experience.

The EU regulation defines the ECB reference currency conversion rate as a common benchmark for comparing the cost of foreign exchange, whereas most bank card issuers source their currency exchange services from the card schemes (including Mastercard, Visa, AMEX, etc.). Historically, these card schemes provide foreign currency services at rates which have varied vs. the ECB benchmark. Assuming this variance continues, European banks will be communicating different currency conversion costs for every currency, every day – resulting in an inconsistent customer experience which will leave customers confused as to the true cost of using their payment cards abroad.

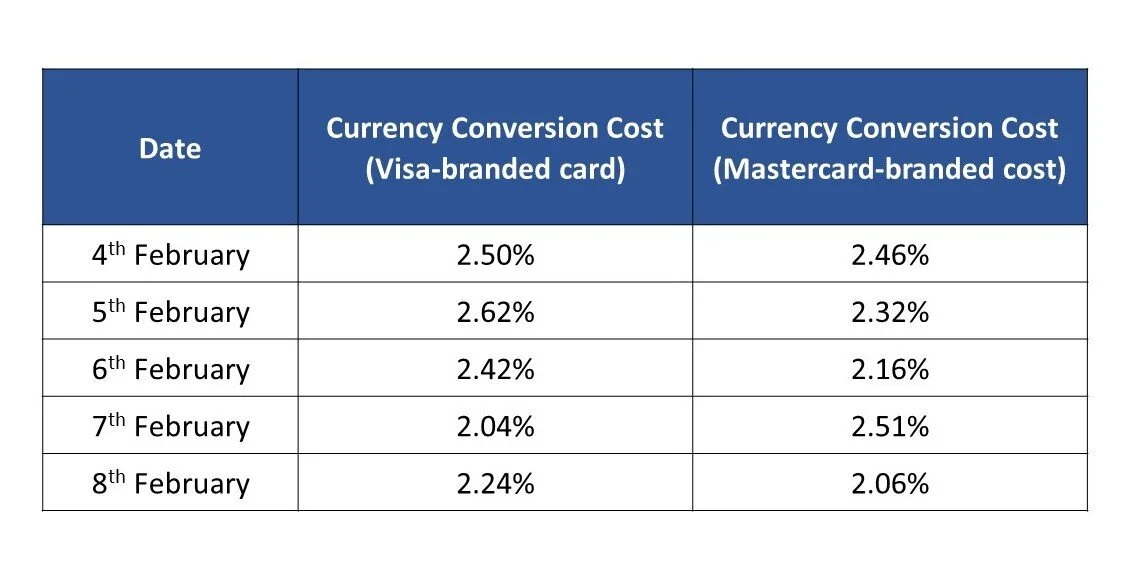

Consider the example of a leading French bank which applies a 2% fee on all cross-border card payments. The following data presents the total currency conversion costs as a % above the ECB rate which this French bank would have communicated to its customers traveling and spending money in the UK in the first week of February this year (e.g., spending in GBP and being debited in EUR):

As a French consumer, the experience of receiving notifications from your bank each day, presenting a different cost of spending in GBP is likely to become, at a minimum, a marketing and communication challenge and, at worst, a tangible opportunity for disruptive new competitors to capture market share.

As with every new regulation, the devil will be in how banks across Europe choose to respond and implement these new requirements. TransferWise, Curve, Revolut and their peers have a significant advantage both (i) in their ability to present timely, accurate currency conversion information to their customers and (ii) the consistency of their pricing structures as compared to interbank FX rates.

Cambrist is uniquely positioned to help existing issuers of debit, credit and prepaid card products take an innovative approach to addressing this new regulation, whilst improving the end consumer experience of using their card when paying in a foreign currency. If you’d like to discuss how Cambrist can help your business, please email us at info@cambrist.com, visit our website at www.cambrist.com or contact me or any of our team via LinkedIn.