Decision Time for CEE Issuers on Non-Local Currency Settlement Structures

Issuers across Central & Eastern Europe have long operated multiple settlement services with Visa & Mastercard. These services differentiated between domestic transactions that are settled in the Issuer’s local currency and international transactions that are settled in a major international currency (either USD or EUR). This set-up is typically referred to as a Non-Local Currency Settlement (NLCS) structure.

The origin of these NLCS structures is in the lack of established International Settlement Services in the domestic currencies of CEE Issuers. However, this has come increasingly into focus as both Visa & Mastercard have added International Settlement Services in new currencies across CEE. Now, as International Travel rebounds post Covid19, Visa are implementing a new fee targeting this NLCS settlement set-up. This fee will add up to €1m of annual fees for CEE Issuers from 2024 who do nothing. To be ready for 2024, Issuers should be making decisions now on their approach to settlement for international transactions and how this affects their existing NLCS set-up.

Visa NLCS Fees

Visa has introduced a new fee for non-local currency settlement (NLCS). This fee, which is being phased in across Europe, is expected to have a significant impact on Issuers in Poland, Czech Republic, Hungary, and Romania. From 2024, Issuers with NLCS settlement structures can expect to pay a new fee of 10bps across all international transaction volumes. For a Tier 1 Issuer, this could see new Visa fees of up to a €1m annually by mid-2024.

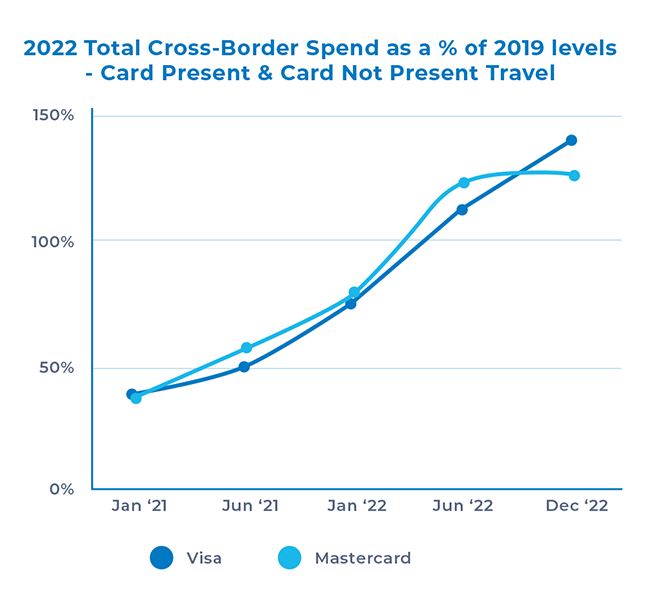

The recovery in International Travel post Covid19 will make this new fee more relevant to Issuers in the short term. According to Visa and Mastercard, cross-border travel spend growth has reached 38% year on year, surpassing pre-Covid levels. Visa & Mastercard forecast continued growth in cross-border spend in 2023 & 2024, particularly as consumers currently consider travel to be their highest priority for discretionary spend. 42% of survey respondents made travel a high priority in 2023 (vs. 27% for restaurants, 25% for fashion and 20% for big ticket items such as new cars).

This new fee, aligned to the resurgent growth of international card spend and the project time required to alter scheme settlement structure and align internal operations means that CEE Issuers should be considering their approach to pre-existing NLCS settlement structure before June 2023.

Issuer NLCS Decision Framework

This decision needs to be considered in the context of (i) the expected cost of the new NLCS fees, (ii) the project requirements to implement changes to any existing NLCS settlement structure, in particular the internal reporting & reconciliation impacts of any project, (iii) available project resources and competing project priorities and (iv) the appropriateness of any settlement service to the Bank’s card proposition, particularly with respect to existing multicurrency account propositions that are common for CEE Issuers.

In this decision, Issuers have 3 options to consider:

Maintain existing NLCS settlement structures and pay the new fees. At a time of stretched IT resources, this will be an attractive short-term option for Issuers who do not wish to prioritise back-office/treasury IT projects vs. customer facing or regulatory projects.

Migrate all settlement to their Domestic Currency and pay Scheme FX rates on all transactions. This will require prioritization of IT resources to change existing settlement structures and the associated reconciliation and reporting processes, whilst also exposing the Issuer to higher Scheme FX Rates on all transactions, increasing costs.

Work with 3rd party providers to assess Treasury-as-a-Service offerings for both NLCS and Multi-Currency Settlement service options. This option can mitigate the NLCS fees while reducing internal IT/Project resource requirements. In addition, CEE Issuers with pre-existing multi-currency settlement services would improve the operational efficiency of these propositions.

Summary

The introduction of NLCS fees by Visa will have a significant impact on banks in Poland, Czech Republic, Hungary, and Romania. Issuers in these markets have a decision to make on the most appropriate settlement set-up in the context of their cost position, project priorities and product proposition.

Given that the full extent of these charges come into force in mid-2024, we advise Issuers to start reviewing their option by June 2023 in order to have sufficient time to design, test and launch their preferred settlement strategy. Cambrist is an expert in Scheme Settlement Operations and provides Treasury-as-a-Service solution to Issuers with both NLCS and Multi-Currency Settlement Services. Contact us now to discuss the options available to Issuers.